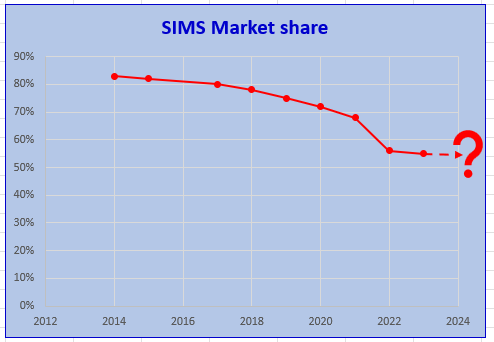

So, what is happening to the MIS players? Have schools continued to switch away from SIMS to other providers or has the slide been halted?

Our thanks, once again, go out to our good friend Joshua Perry who analyses each set of census data and provides insights into the MIS market players, how many schools they have, the ‘winners and losers’ etc. in his blog and allows us to use this data here.

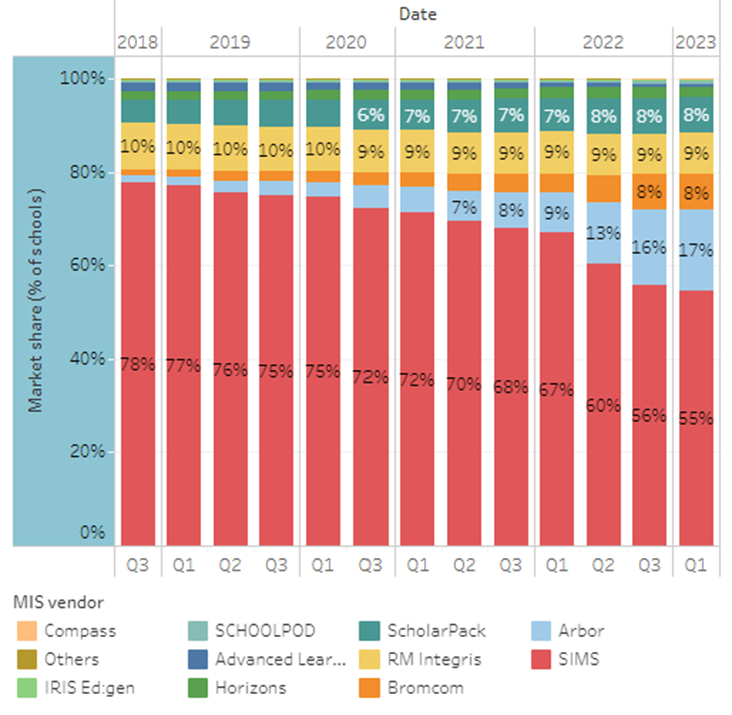

Following the publication of the January 2023 census data, we can see that the churn in the MIS market continues. This census reports on MIS moves between October and January which is traditionally a very quiet period for MIS changes yet, despite this, over 300 schools switched their MIS during this time.

As expected, the biggest ‘loser’ was, yet again, SIMS who lost another 242 schools. Whilst this is a fairly low figure compared to the numbers that they lost in previous periods it is still their highest loss in these months that we have ever seen and reduces their market share to just 55% of English state schools. When you consider that just 5 years ago SIMS held almost 80% market share, their fall from grace is dramatic.

As most will know, The Key are in the process of acquiring RM Integris with the CMA (Competition and Markets Authority) investigating currently and due to announce their decision by 16th June 2023. Assuming the acquisition does go ahead, The Key will be providing MIS systems (RM Integris, Arbor and ScholarPack) to more than a third of English state schools.

Added to this, Arbor continues to be the biggest ‘winner’ in the MIS stakes, gaining 236 schools during the period, some 76% of all schools that switched.

Bromcom also won a further 43 schools during the period, accounting for 14% of all those that switched, showing that they are also pushing ahead well. We know that they have also won some big deals which will mean their numbers growing again across the current term which will be reflected in the next census.

Although the census takes place this month (May 2023) the results are not usually published until August but this will be very illuminating since this period is traditionally the one where we see the most SIMS schools switch, due to the fact that their contracts used to renew at the end of March annually.

SIMS brought in the 3-year contracts in an effort to stem the tide of losses, so it will be interesting to see if this has worked for them once we get the next set of data. In the same period last year, soon after the 3-year contracts were brought in, we saw almost 1,500 schools switch away from SIMS. In the previous year, before the 3-year contracts were introduced, SIMS lost a little under 500 schools and will need to keep losses in the next results down to that sort of level or they will have to accept that their ‘cunning plan’ has not worked as they hoped!